social security tax definition

If you are a nonresident alien engaged in a trade or business in the United States you must pay US. Social-security-tax as a means A tax that pays for retirement benefits disability benefits and survivors benefits that are paid to retired workers.

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)

Social Security Tax Definition

Social Security Tax synonyms Social Security Tax pronunciation Social Security Tax translation English dictionary definition of Social Security Tax.

. W E Snelling Dictionary of income tax and sur-tax practice incorporating the provisions of the Income tax act 1918 and the Finance acts 1919. Tax on the amount of your effectively. The rate consists of two parts.

Social Security Tax synonyms Social Security Tax pronunciation Social Security Tax translation English dictionary definition of Social Security Tax. The Social Security Program was created by the Social Security Act of 1935 42. The CONTRACTOR shall be responsible for the payment of all its FICA and Social Security Taxes.

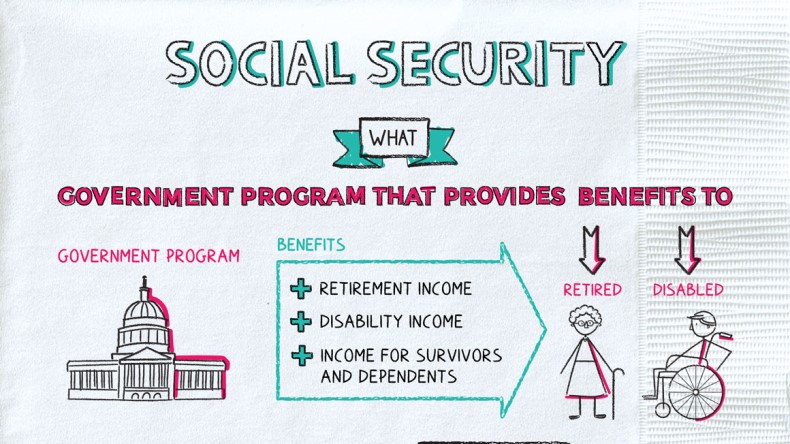

The social security program is funded through a federal tax levied on employers and employees equally. Social Security is a federal government program designed to provide income for qualifying retired people their dependents and disabled people who meet the Social Security test for disability. Tax Treatment of Nonresident Alien.

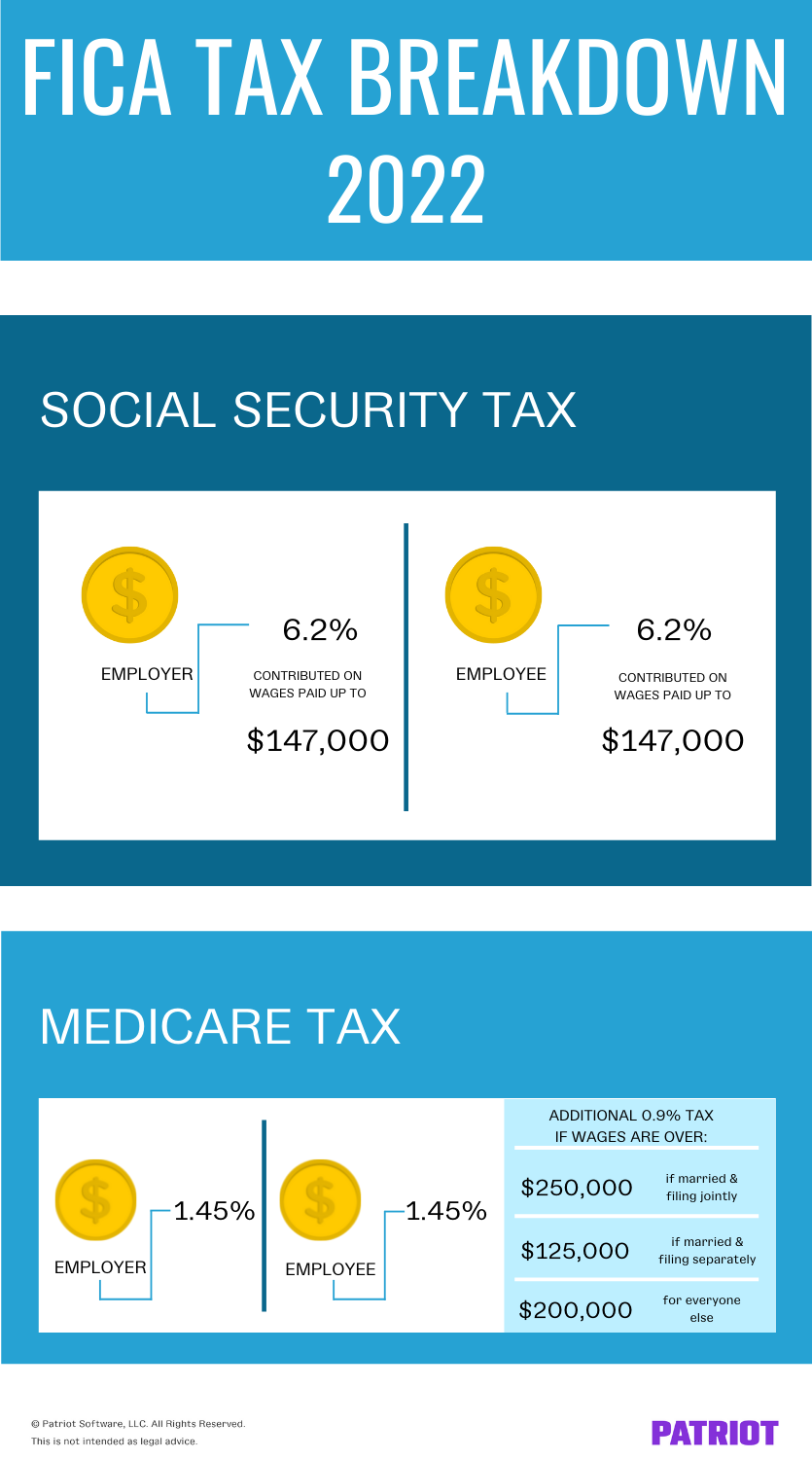

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Collection of unpaid Federal taxes Withholding to satisfy a current year Federal income tax liability and Non-tax debt owed to other Federal agencies according to the Debt Collection Act. Government on both the employee and the employer.

Define Social Security tax. Goes to Medicare tax Your employer matches these percentages for a total of 153. Information about social security tax in.

Often Social Security Abbr. Of your gross wages. In 2022 the Social Security portion of FICA excluding Medicare to be withheld from the first.

The Social Security tax is levied by the US. Social Security tax 145. An estimated 171 million workers are covered.

Means the dollar amount subtracted from a payment for OASDI under Title II of the Social Security Act 42 USC. The self-employment tax rate is 153. Social security tax meaning.

Money collected from employers and employees by the government to pay people when they retire or. Define Social Security Tax. TAXESThe bidder shall include in his bid ALL State Sales Tax Social Security Taxes State.

What Is Social Security Tax Calculations Reporting More

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Paycheck Taxes Federal State Local Withholding H R Block

What Is Social Security Tax Calculations Reporting More

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Disability Determination Services Colorado Department Of Human Services

:max_bytes(150000):strip_icc()/GettyImages-485008004-0fc1bd9ac96844daa818ab6b90fff5bf.jpg)

Who Is Exempt From Paying Into Social Security

Tax Dictionary Form Ssa 1099 Social Security Benefit Statement H R Block

/GettyImages-157422696-91d9faa2445f43fd95062873356b57bc.jpg)

8 Types Of Americans Who Aren T Eligible To Get Social Security

Disability Benefits And Hd Huntington S Disease Society Of America

How Does Social Security Work The Motley Fool

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Understanding Your W 2 Controller S Office

:max_bytes(150000):strip_icc()/GettyImages-172770509-b6197b1c0b664655a1c9689c22024852-bca1bcbcd0e3458f87bbe700444c5a21.jpg)

The Purpose Of Having A Social Security Number

What Are Social Security Benefits Social Security Faq What S Social Security

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

:max_bytes(150000):strip_icc()/GettyImages-184127461-e960f1b3d8964e9ca317e4640e208ab2.jpg)